In the fast-paced world of finance, timely and accurate credit rating reports are crucial for banks and lending institutions to manage risk and optimize capital allocation. Traditionally, generating these reports has been a manual, time-consuming process fraught with inconsistencies. However, the integration of AI and large language models (LLMs) offers a transformative solution. Here’s an overview of how a credit rating data product can revolutionize this critical task, based on a real-world solution developed for an international bank.

The Problem

Generating credit rating reports manually took up to six weeks and often resulted in inconsistent evaluations. For a bank, this inconsistency posed a significant challenge in managing risk and capital costs effectively.

The Solution

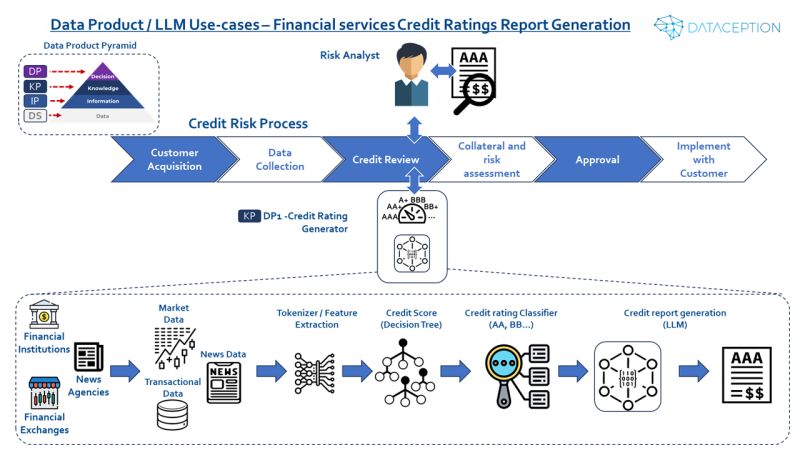

A credit rating data product, leveraging ensemble-based machine learning (ML) and AI, was developed to create credit ratings from both traditional data sources (e.g., trades, transactions, market data) and alternative data sources (e.g., news). This automated approach drastically reduced the time needed to generate reports and ensured consistency across evaluations.

Key Features of the Credit Rating Data Product:

- Data Integration: Collects data from various sources, including traditional financial data and alternative data like news.

- ML/AI Processing: Utilizes a decision tree ML regression algorithm to produce a credit score.

- Classification: Transforms the credit score into an industry-standard rating.

- Report Generation: Uses a decoder LLM to generate a comprehensive credit report based on the rating and contributing data.

- Human Review: Allows credit risk analysts to review and utilize the report in downstream processes.

- Machine-Readable Outputs: Provides scores in a format that can be combined with other data for further analysis, such as portfolio valuation and collateral assessment.

The Credit Rating Process

Here’s a step-by-step breakdown of how the credit rating data product integrates into the banking workflow:

- Customer Acquisition: The bank acquires customers through sales and marketing processes.

- Data Collection: Data is requested manually or collected electronically via integrations.

- Credit Review Process: A credit report is generated, explaining the rating and any changes (e.g., "Organization X has been downgraded because of Y").

- Report Generation:

- Data Ingestion: Takes in data from various feeds, tokenizes it, and turns it into features.

- ML Regression: Runs a decision tree ML regression algorithm to produce a credit score.

- Classification: The score is passed into a classification model to generate the industry rating.

- Report Compilation: The rating and all contributing information are used by a decoder LLM to generate a detailed report.

- Review and Utilization: The credit risk analyst reviews the report and uses its content in downstream processes.

- Collateral and Risk Assessment: Combines machine-readable scores with other data for further assessments.

- Approval Workflow: If the assessment falls within the required risk profile, the approval process is triggered.

- Execution and Engagement: Upon approval, the contract is executed, and the customer engages with the bank for the financial instrument (trade, loan, etc.).

Lessons Learned

One key insight from this project was that while the AI models did not necessarily produce more accurate ratings than human analysts, they offered much greater consistency. This consistency is crucial for banks as it leads to more predictable cash flow and accounting, ultimately improving capital allocation and risk management.

Clarifying Terminology

There is often confusion between "data products" and "AI products." In this context, a data product is designed for leveraging data to build applications, whereas an AI product is geared towards delivering specific business or operational outcomes through advanced analytics and data. Understanding the intended audience is crucial for ensuring that the product meets their needs effectively.

Ensuring Accuracy and Reliability

To ensure the accuracy and reliability of the ensemble-based ML/AI solution, several strategies were employed:

- Utilizing Existing Data: Leveraging existing scores and credit analyst reports for training, labeling, and testing purposes.

- Transparent ML Models: Using decision trees and random forests, which are easy to interpret and tune.

- Domain Expertise: Involving subject matter experts (SMEs) to examine key features and validate the model’s performance.

Project Timeline

The initial iteration of this solution took several months to design and build, with significant effort devoted to report generation. With advancements in LLMs, the architecture has since been updated to incorporate the latest technologies, further enhancing the system’s efficiency and capabilities.

Conclusion

This case study highlights how integrating AI and LLMs into credit rating processes can streamline operations, improve consistency, and enhance risk management. By adopting such advanced data products, banks can respond more swiftly to market changes and make more informed decisions.

Call to Action

For more insights and real-world examples of AI and data product integration, feel free to reach out to us at Dataception Ltd.