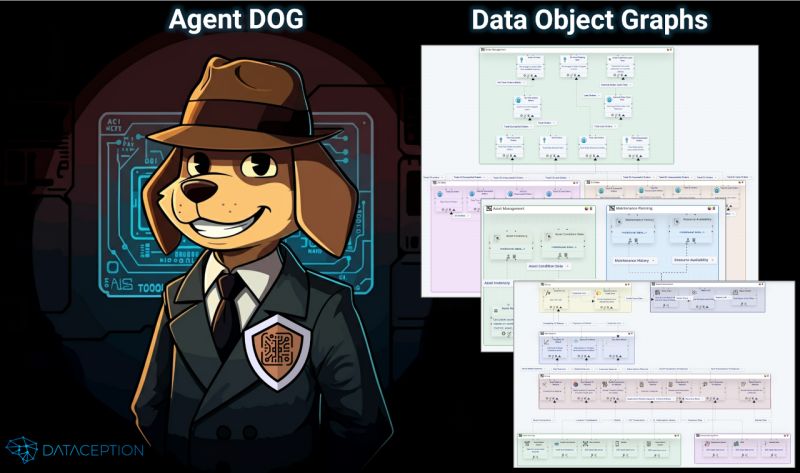

Meet Agent DOG, Dataception's innovative Data Object Graph designed to transform business challenges into opportunities. By unifying data and automation, Agent DOG delivers agile, cost-effective solutions that drive efficiency and minimize risks. Discover how this cutting-edge framework empowers enterprises to achieve smarter, faster decision-making.

Welcome to the thrilling world of Agent DOG—our top-secret operative in the realm of data and AI. In "A Real-World Tale of Data Object Graphs in Action," we embark on a high-stakes mission where Agent DOG is unleashed to transform the core operations of Guardian Insurance. Armed with cutting-edge Data Object Graphs and a suite of AI capabilities, Agent DOG is set to sniff out inefficiencies, fetch innovative solutions, and bring about a revolution in business processes.

In this classified dossier, you'll follow Agent DOG through a series of covert operations:

Prepare to delve into an action-packed narrative that blends espionage flair with technological prowess. As you accompany Agent DOG on its mission, you'll discover how Data Object Graphs serve as the secret weapon in transforming business operations. From decoding complex data puzzles to orchestrating a symphony of AI agents, this tale showcases the power of innovative solutions in a fun and engaging way.

So, tighten your collars and adjust your bow ties—it's time to unleash Agent DOG and embark on a journey where every data node is a clue, every graph is a map, and every mission brings us closer to a new era of efficiency and intelligence.

"Agent DOG, your mission, should you choose to accept it, is to transform Guardian Insurance using your specialized AI, Data Object Graph, and Data Product skills. Previous agents—Data Lake 001 and Agent Warehouse—have failed. You're our most advanced operative: a Data Object Graph agent with rapid data product capabilities."

Agent DOG adjusted his digital bow tie and neural connectors. "Mission accepted, Chief. My specialty is connecting dots others can't even see."

In the silent boardroom of Guardian Insurance, CEO David Thompson laid out the challenge. The once-leading insurance company was drowning in manual processes, siloed data, and mounting operational costs.

Agent DOG's AI cores hummed as it analyzed the challenge. Its unique capabilities would be put to the test:

"The difference," explained Sarah Chen, the Chief Digital Officer, "is that Agent DOG doesn't just automate—it creates specialized data products that learn and evolve. Each solution it generates becomes a building block for future innovations."

Agent DOG quickly absorbed the mission parameters and set off.

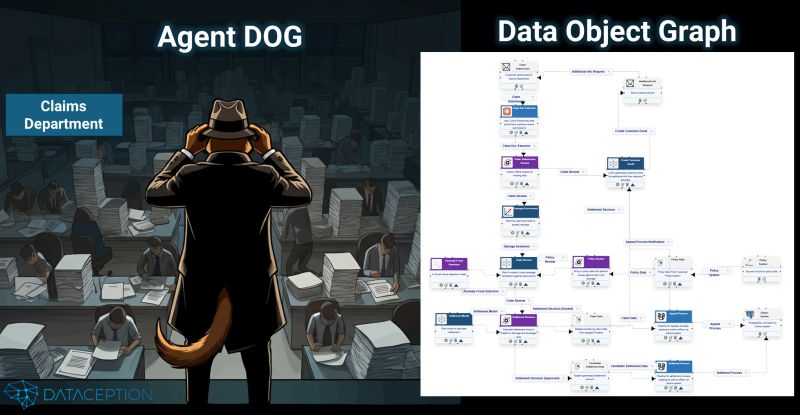

As Agent DOG entered Guardian Insurance's Claims Department and surveyed the landscape, its neural circuits pulsed. The scene was chaotic: claims processors overwhelmed with paperwork, customer satisfaction plummeting, and processing times stretching into weeks.

"This is where existing approaches failed," whispered Jenny Martinez, Head of Claims. "The data was too unstructured, too complex. Previous attempts to fix this took too long, and we were drowning in tech and getting nowhere."

Agent DOG's AI cores hummed confidently. "Show me your typical claim type."

Martinez pulled up a house water damage case received via email from a customer. The email included PDFs, images, and natural language text.

Within minutes, Agent DOG dipped into its kit bag and quickly prototyped a specialized Data Object Graph, including the following Data Products:

All designed for automated processing but with Claims Officer oversight.

Agent DOG asked Jenny, "Does this fit the bill?"

"Very close," Jenny replied. "Can we add notifications to the customer?"

Within minutes, Agent DOG added the new Data Products as nodes.

Using its toolkit, Agent DOG seamlessly connected and deployed these AI products into the intelligent claims processing workflow. Within days, the transformation was visible.

"But how do we know it's accurate?" Martinez challenged.

"Each decision node in my graph is explainable and auditable," Agent DOG adjusted its digital bow tie. "I don't just process—I learn and adapt."

The Claims Department staff watched in amazement as their backlog began to shrink. But Agent DOG knew this was just the beginning. Tomorrow would bring an even bigger challenge: Risk Assessment.

At dawn, Agent DOG ventured into Guardian Insurance's Risk Department, neural bow tie gleaming.

"Your risk processes are limited, inefficient, and painfully manual," he murmured to the Risk Director.

"But what if we could automate them—reducing costs, boosting accuracy with advanced AI models, and maximizing customer service while keeping risk low?"

Reaching into his digital toolkit, Agent DOG activated the Rapid Prototype-X device—a cutting-edge AI tool for swift prototyping and deployment. Within minutes, holographic data streams appeared, revealing an automated risk assessment flow powered by real ML models and live data.

"Watch this," Agent DOG said, adjusting his neural bow tie. The Prototype-X hummed, weaving together data and AI components into an executable Data Object Graph (DOG)—a dynamic, living risk management process.

Agent DOG clicked on the “Premium Calculator” node. The team watched in awe as the system:

Decades of static rules instantly transformed into adaptive risk intelligence, leaving the Risk Director marveling at the possibilities.

Data Object Graph (DOG):

ML Model Integration:

By uniting AI, data, and dynamic orchestration in a single cohesive framework, Agent DOG enabled Guardian Insurance’s Risk Department to reduce costs, improve accuracy, and offer faster, more customer-centric services.

The adventures of Agent DOG with Guardian Insurance continue as our intrepid operative sets his sights on Underwriting, wielding advanced analytics to optimize decision-making and unleash new levels of efficiency.

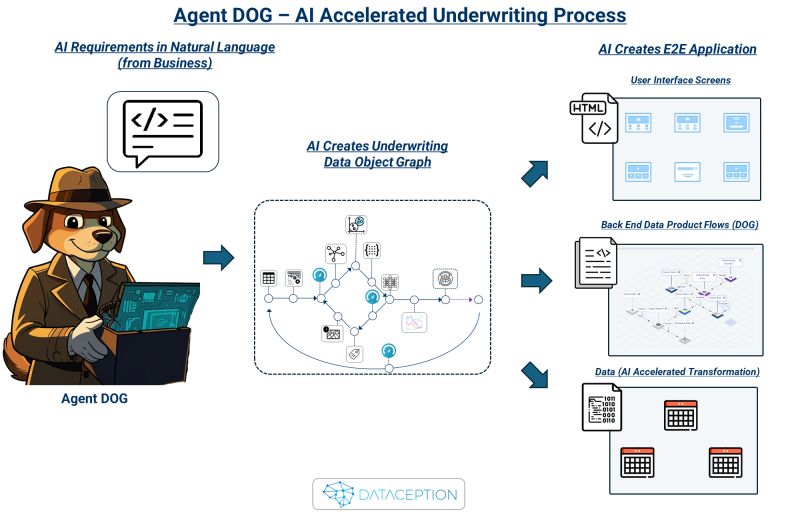

Agent DOG slipped into the Underwriting Department at sunrise, neural bow tie gleaming. "Your underwriting process," he addressed the Underwriting Business Lead, "is confined by traditional workflows. What if we could transform it into a dynamic, intelligent ecosystem?"

With a dramatic flourish, Agent DOG launched Operation Digital Twin, powered by the Prototype-X device. This cutting-edge tech translated the Underwriting Lead’s requirements via sophisticated natural language prompts. “Observe,” commanded Agent DOG, as holographic data streams took shape.

The entire prototype was refined through fast, iterative collaboration with the business team, also allowing for code-based customization. Months of traditional development compressed into mere moments.

“But here’s the real magic,” Agent DOG grinned, pressing a single button. The fully-formed underwriting system was seamlessly deployed to production, with no complex handoffs or lengthy development cycles.

"Welcome," Agent DOG declared, "to the future of underwriting."

As Guardian Insurance steps confidently into this new era, the power of Data Object Graphs and Agent DOG’s uncanny ability to translate business vision into operational reality take center stage—proving that with the right blend of intelligence and innovation, even the most traditional processes can evolve at lightning speed

Get in touch to see how we can revolutionize the way your businesses handles data and analytics through our Rapid Predictable Data and AI Delivery model.

Explore our Services Contact Us Today